I constantly worry about my financials, especially when a slew of scams and hacking schemes are launched around the world. After all, I can’t just run to an ATM or branch location, especially not in the middle of the night.

Thankfully, one of the most trusted banks has made it even easier for me to do banking in the comforts of my own home or even when I’m on the go. This is no other than Capital One. I find it praise-worthy that this financial institution has taken the steps to make its services more accessible to customers than ever.

In this article, I’ll be detailing what the Capital One mobile app has to offer, how I can get a credit card through it, and more. Read on to learn about this particular app and how it has greatly helped me in my day-to-day life.

- Get to Know the Capital One Mobile App

- Features of the Capital One Mobile App

- Walking You Through Using the Capital One App

- Getting a Credit Card Through the App

- Tips for Using the Capital One Mobile App

Get to Know the Capital One Mobile App

The Capital One app is the dedicated mobile application provided by no other than Capital One. Other people like me who already bank with this institution may already know Capital One as an American banking company.

This particular company offers a wide range of financial services and products, something I am greatly appreciative of, particularly as this allows me to choose what I need. These include loans, credit cards, savings accounts, and many others.

I believe that Capital One truly makes its consumers and clients feel valuable by extending this full-featured mobile application. This app, after all, allows me to manage my account effectively with just a click of a button.

The Capital One mobile app is available for both Android and iOS users. Ideal for card and account management, the app lets me look at my savings and credit accounts, the bank’s CreditWise tool, and other management features.

Services Offered by the App

What’s great about the Capital One mobile app is that it gives me everything I would ever want and more in a banking app, particularly in making certain transactions more accessible and hassle-free.

This includes depositing checks immediately, transferring funds, requesting checkbooks, and even paying bills.

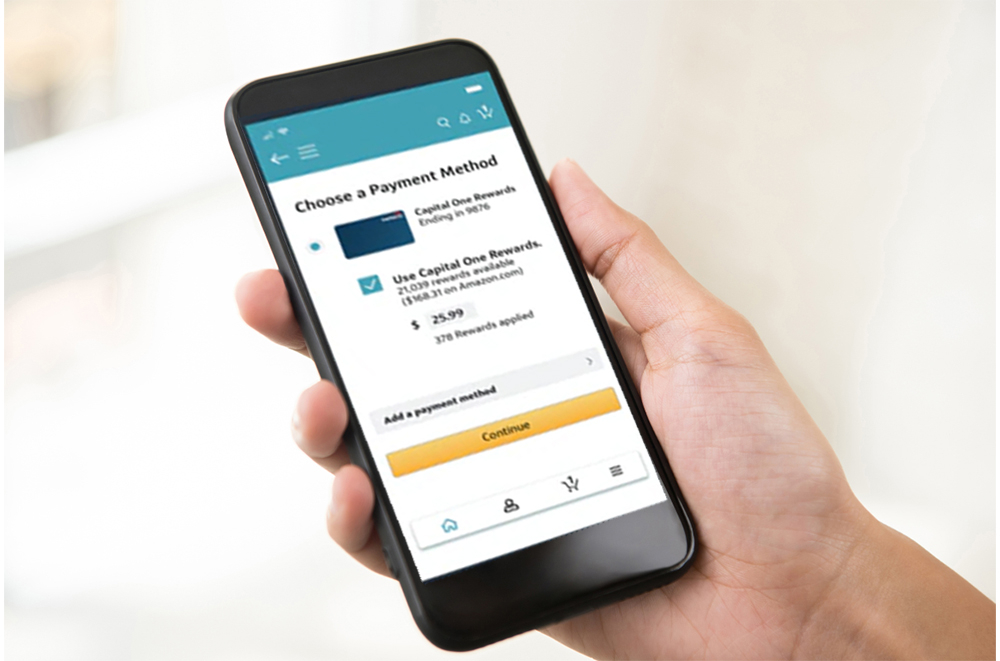

One of the things that I particularly love about the Capital One mobile app is that it lets me get and apply for a credit card with ease, making it a more seamless transaction on my end.

Features of the Capital One Mobile App

There are numerous features that come with the Capital One mobile app. Perhaps one of the most important features that I feel I should point out is its ability to grant me complete access to my account information and details, including my card number, security code, and expiration date.

This feature helps me make transactions conveniently online or even using the phone, especially since I don’t have or bring my card around with me all the time. I can likewise keep tabs on my credit using the CreditWise tool. This allows me to learn not just about my current credit score but also about how I can further improve it.

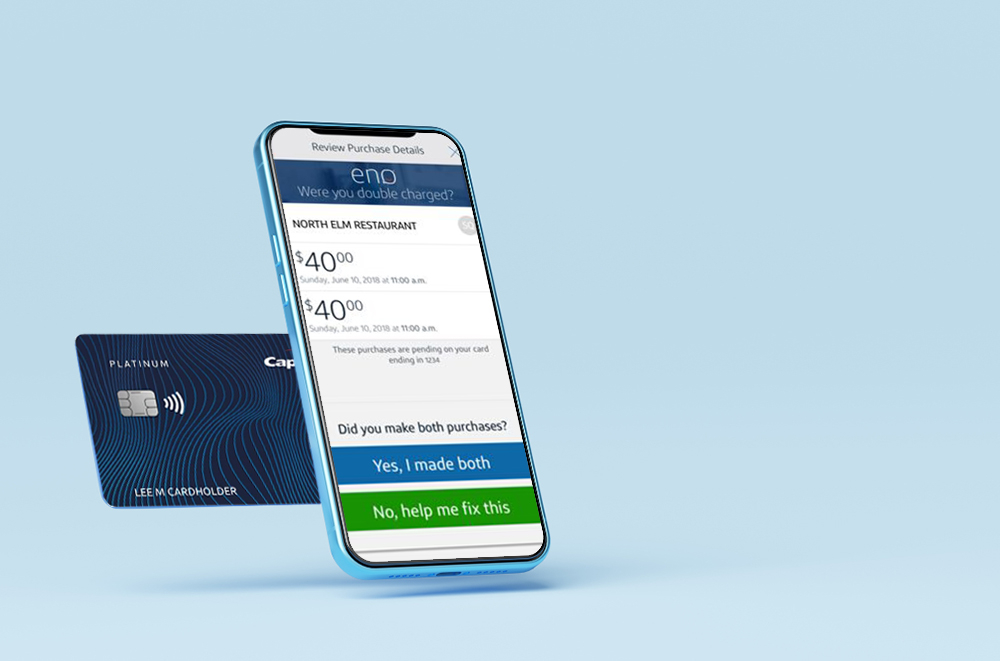

Moreover, the Card Lock feature is also helpful. It comes in handy if I ever lose my card or even have had some fraudulent transactions in it. Through this, I can easily disable or stop transactions on my card or account with just a push of a button.

Speaking of transactions, I can deposit checks right away just by taking a photo of them. Other transactions, such as sending money to other people within the United States, are made possible with the help of the Zelle service.

Other Notable Features of the App

Security and protection are top-notch, even when my transactions are made via the Capital One mobile application. Here, I can not only send money securely but also view my transaction history and my statements.

In line with this, I believe Capital One takes care of its customers every step of the way. Besides convenience, it provides timely notices and alerts for every transaction or spending I have on my account, giving me a clearer picture of my finances.

Moreover, the CreditWise service extended by Capital One immediately informs me if my account or any of my account-related details have been compromised on the web. This includes my email address and Social Security number, giving me ample time to take the appropriate action.

Walking You Through Using the Capital One App

Before being able to use the Capital One mobile app, I need to download and install it on my phone. The Capital One Mobile app is available for Android and iOS users. All users need to do is check out the Google Play Storeor the App Store and tap ‘install’ to proceed.

After downloading the app, I needed my username and password to log in to the app. For those who do not yet have an account with Capital One, setting it up is a breeze. The entire process can be done through the app as well.

After logging in with my username and password, I will immediately see accounts under my name, as well as the corresponding amounts and due dates associated with these. The home screen also lets me have a close look at my transactions and statements.

I can view a separate screen to display other account details. Here, I can see the last statement balance and my payments.

What You Need to Know

In order to fully streamline the use of the Capital One mobile app, I believe that having the right compatibility for my phone or device is essential.

For iOS users, the app in question is around 397 megabytes, and it requires an iOS 14.0 or later to be fully operational or functional.

On the other hand, if I do decide to use the app on an Android device, it would require me to have an Android that operates on version 8.0 and up.

Getting a Credit Card Through the App

I have mentioned earlier that getting a Capital One credit card via the mobile app is possible, and that still rings true. I am talking about the virtual credit card, and this is made available with Eno. What’s great about the virtual credit card is that it helps me protect my credit card online.

The virtual credit card works by disguising my actual credit card number and generating a specialized credit card number instead. This allows me to shop online without having to fear fraudulent attacks or transactions when I do so.

I can create virtual cards from any website checkout page, allowing me to enjoy seamless and convenient transactions. This card is linked to my Capital One credit card account without actually using the number associated with my original account.

To avail of this service, I have to sign in with my Capital One account and make sure that I have online access to the said account. I can then proceed to set up the online access by tapping on the Eno icon.

Eligibility Requirements and Qualifications

One of the main requirements I needed to meet in order to get a credit card from the Capital One app via Eno is to be a Capital One customer in the first place. I need to have an existing credit card with the bank prior to getting another one.

To apply for a credit card, I need to be at least 18 years of age, live in the United States, and generally have fair credit scores. The bank may require other documents, so make sure to prepare proofs that support these.

Tips for Using the Capital One Mobile App

The Capital One Mobile App is one of the most convenient and accessible ways to keep track of my transactions, so I make sure to take advantage of this platform. For my convenience, I make it a point to register for online and mobile banking first before even downloading the app.

This is a great way to ensure that my experience is flawless, especially during emergencies when I need to gain access to my account immediately.

Another great way to use the app effectively is simply to log into it regularly. This helps me stay on top of my account and detect any suspicious activity.

In Case of Suspicious Transactions

Prompt action is the best way to address suspicious transactions because it minimizes the time criminals have to perform their crimes.

I report any potentially fraudulent transactions to the bank and check my account settings for additional measures.

The Bottom Line

The Capital One Mobile App is great for individuals who like to stay on top of their accounts. With its help, I can make transactions more easily while also monitoring my account for any activity.

References

Eno - Eno, your Capital One assistant

App Store -

Capital One Mobile on the App Store